Swiggy’s double move to hive off its quick commerce vertical Instamart into a step-down subsidiary and exit mobility startup Rapido underscores a strategic shift in its playbook.

The food delivery giant filed the updates in an exchange filing late Tuesday (September 23) evening.

Whispers over Swiggy’s likely exit from Rapido turned louder since the mobility company entered the food delivery space with the launch of Ownly. What was once a portfolio bet had suddenly turned into a competitive conflict for the food aggregator.

The Swiggy board approved the sale of its stake to existingRapido investors Prosus (also an investor in Swiggy) and Westbridge for INR 2,400 Cr. According to media reports, the company reaped a 2.3-fold return on this bet.

Swiggy will spin off Instamart into a separate indirect step-down subsidiary, Swiggy Instamart Private Limited, through a slump sale, said the filing.

On the surface, the Rapido stake sale seemed an obvious move by the company to disentangle from the competition, carving out Instamart signals something deeper. While Swiggy officially positioned the move as a step towards “sharper strategic focus and operational flexibility”, the timing and the structure suggest that the company is preparing for independent scalability, and even a future fundraising.

Instamart’s Shift To Inventory ModelSwiggy has moved away from its super app ambitions. Over the last couple of quarters, the startup has unbundled its offerings to avoid confusion for its users and to sharpen its positioning.

In May, it rolled out a separate Instamart app, clearly indicating that the quick commerce venture needed its own brand identity and growth engine. Swiggy has since followed the same approach for its newer verticals such as Snacc, Pyng, and, most recently, Toing.

But, Instamart continued to be the biggest growth lever for the company. With the food delivery business going lukewarm across the industry, quick commerce turned the primary growth driver for the startup.

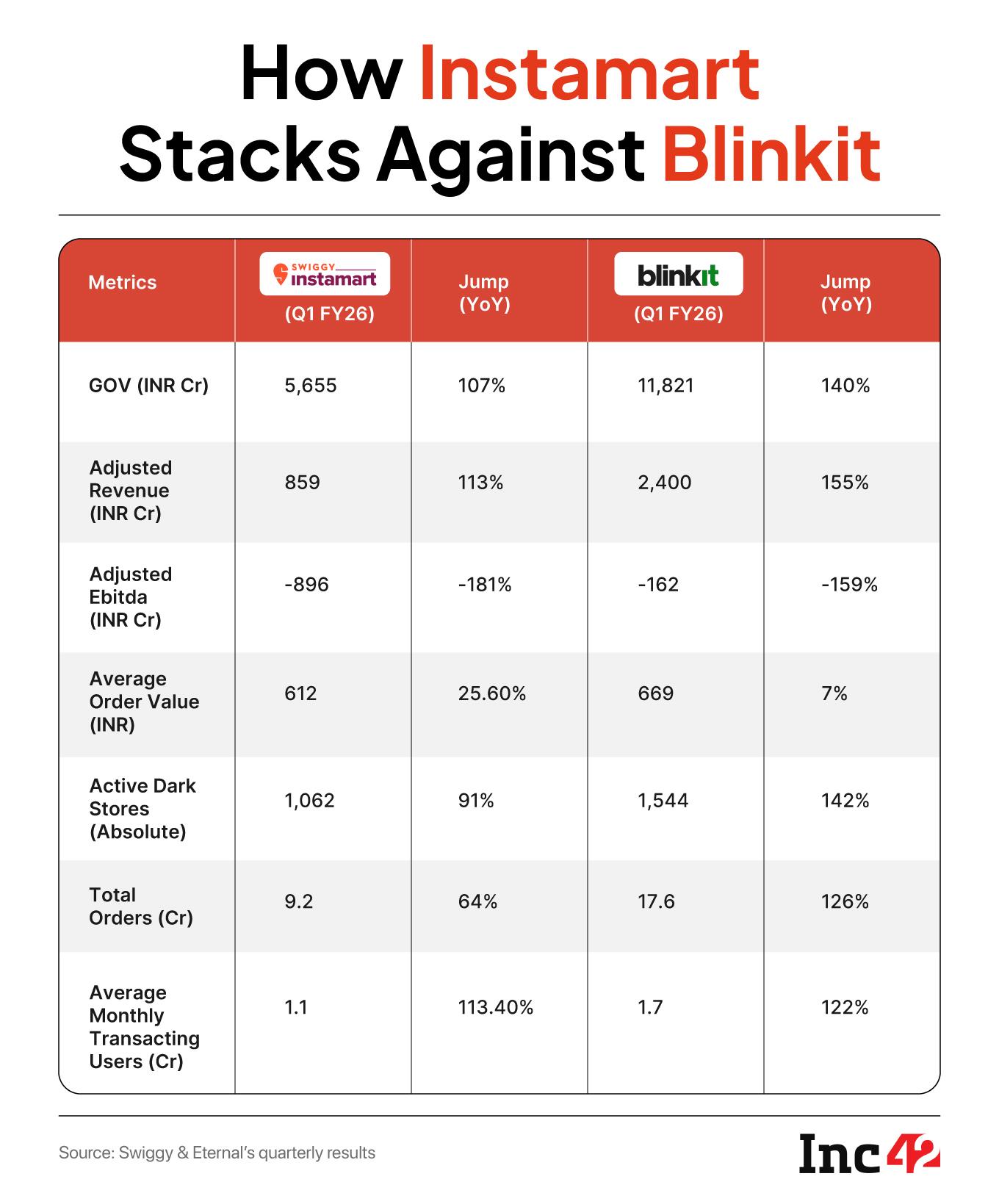

Despite being an early mover, Instamart continued to trail Blinkit, though. While Instamart posted a 100% on-year growth in gross order value in Q1 of FY26, its GOV still stood at nearly half of BlinkIt’s and revenue is yet to reach even the half-way mark.

In a bid to close this gap and to have better control over the operations, Instamart plans a pivot to an inventory-led model from the marketplace structure, where brands are listing their products on Instamart’s application.

The transition would allow it to procure directly from brands and sell them on its platform, replacing commission revenue with net sales. This would mean higher margins, better control over the supply chain, including warehousing and logistics, and better customer service.

BlinkIt made the same drift to the inventory-led model in July.

“Switching to an inventory-led model can help improve the contribution margin of Swiggy’s Instamart business as Eternal expects 100bp improvement from the same,” brokerage firm Nomura said in a note yesterday.

Financially, such a move would also alter Instamart’s reporting. Instead of booking on the margin of sales as its revenue, it would now report its net merchandise value as its net sales.

Fundraising On The Cards?While Swiggy has not officially outlined how it plans Instamart’s transition to an inventory-led model, merely hiving it off into a step-down subsidiary won’t be enough. The real roadblock lies in foreign direct investment (FDI) regulations, which prohibit foreign-funded marketplaces from owning inventory or exerting control over sellers.

With nearly 60% of Swiggy’s ownership tied to foreign investors, a fully foreign-owned Swiggy Instamart Private Limited would still fall under the same restrictions. In other words, unless the shareholding mix changes, Instamart cannot seamlessly switch to an inventory-led model.

That means, Swiggy needs to rebalance its captable towards domestic shareholders. “Swiggy needs to raise domestic capital to increase its Indian shareholding. It can either be primary or secondary,” an industry insider told Inc42, refusing to be quoted on matters of raging debate.

There is a precedent. Eternal, the parent company of Blinkit, faced a similar issue. Foreign investors pared down their stakes and domestic players such as Mirae Asset, Axis, HDFC, Kotak and ICICI stepped in, converting Eternal into an Indian owned and controlled company (IOCC).

Zepto, though being privately held, is following a similar path, deliberately adding more domestic backers for regulatory flexibility.

In Swiggy’s case, the need for domestic capital aligns with the financial necessity to fund Instamart’s growth. JM Financial yesterday estimated that Swiggy requires around $500 Mn to fuel growth in Instamart. Given the capital-intensive nature of quick commerce – from setting up dark stores to logistics, and now procuring inventory – a fresh round of fundraising looks inevitable.

Swiggy insiders, however, said that the company has enough capital and there’s no need to raise funds for its expansion at the moment.

A more logical approach would be tapping domestic investors, while addressing both growth requirements and regulatory constraints.

Edited By Kumar Chatterjee

The post Did Swiggy Hive Off Instamart To Help In Inventory Pivot, Fund Raise? appeared first on Inc42 Media.

You may also like

Moment man strolls into hospital before killing ex with shotgun in front of patients

What Tottenham's £100m change this week meant at the Premier League club

Pimpri-Chinchwad Crime: Lawyer Defrauded Of ₹1.80 Crore By Cyber Impersonators Posing As CBI Officers

GST on Old Gold Jewellery: Do You Need to Pay Tax When Selling Your Ornaments? Full Rules Explained

Man finds collectable item in charity shop for £55 and is 'surprised' by true value